What is Forty Seven Bank?

Forty Seven is a unique project built to create a modern universal bank for both users of cryptocurrencies and adherents of the traditional monetary system; banks to be recognized by international financial organizations; a bank that will comply with all regulatory requirements.

Forty Seven Bank will be a financial institution without a digital innovative branch that fully complies with all EU directives, Basel III, Financial Conduct Authority (FCA), Prudential Regulation Authority (PRA) and Bank of England requirements.

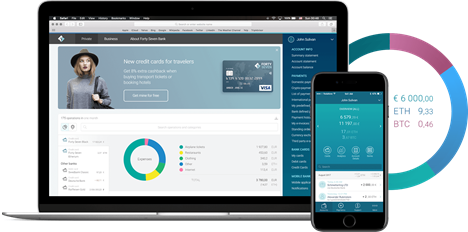

Banks will specialize in digital financial services by fully supporting cryptococcus and traditional fiat currencies. The basic cryptanosity procedures include sales and purchase features, investment options and exchange and storage of crypto and gyro. Multi-Asset Account will be one of the leading innovative products supported by Forty Seven Bank. this will allow customers to have access to all their accounts in different banks and crypto wallets as well as their investment and savings in equations of cryptocurrency and fiat through a single application. It will be possible to operate with each asset type in accordance with having only one Multi-Asset Account in Forty Seven Bank.

Their goal is to create such a market and take a leading position in both the short and long term perspective. Companies will be able to withdraw finances through products discovered by Forty Seven Bank - Cryptobonds. Cryptobonds will be traded on various exchange platforms (mainly developed by Forty Seven Bank).

MISSION FORTY SEVEN BANK

Forty Seven Bank's mission and management team is to provide safe, innovative and easy-to-use financial services and products to our customers - individuals, businesses, developers, merchants, financial institutions and governments. Forty Seven Bank is a bridge capable of connecting the two financial worlds and building efficient communication between the two, a communication that will open the possibility of improving the modern financial system as a whole.

INNOVATIVE PRODUCTS FORTY SEVEN BANK

- Identification and remote authorization based on passport and biometric data

- Unique combination of payment tools - SWIFT cards, credit and debit cards, e-wallet, secure crypto payouts

- Transactions with any type of cryptococcus in the bank application and without the need to wait for the current exchange.

- Coupons, withdrawals and paired conversions are available

- Various services including crediting, insuring, invoice presentation, credit / debit card management etc.

- Cross-platform access to manage client accounts opened in European banks in accordance with PSD2 orders

- UI is convenient and user-friendly

- Analysis that helps the client make the right financial decisions by using a personal manager service made based on the machine learning algorithm.

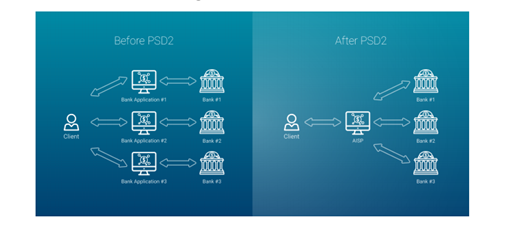

PSD2

PSD2 opens up various opportunities for the banking industry, especially for

financial technology start up like Forty Seven Bank. Any bank in the EU will do so should adjust its systems and infrastructure to conform to PSD2. For a classic bank with a long history, it is very complex, time consuming and expensive.

PSD2's goal is to increase the digital noise that is changing the future of the banking sector. PSD2 invites new market players to enter a healthy competitive environment to gain market share currently controlled by traditional banks. Today, classical banks have a monopoly on their customer transactions and payment services. PSD2 changed the rules of the game. This enables customers to choose third-party service providers for all their needs, which ensures the security and the most appropriate product due to open market conditions.

PROPOSITION FOR BUSINESS

- Business products are oriented towards small and medium enterprises.

- Managing accounts through the Application Programming Interface (API), creating financial applications.

- Receive payment from merchants on both crypto and money in a fiat account (cards, SWIFT) using form or API.

- Bulk payments for the market

- Loyalty management for clients uses large data

- Factoring services based on machine learning and large data (artificial intelligent algorithms can predict the probability of repayment of credit and the timeliness of financial assistance to companies)

- Escrow service

- Mobile app with biometric identification for multi-currency transactions

Token distribution

RoadMap

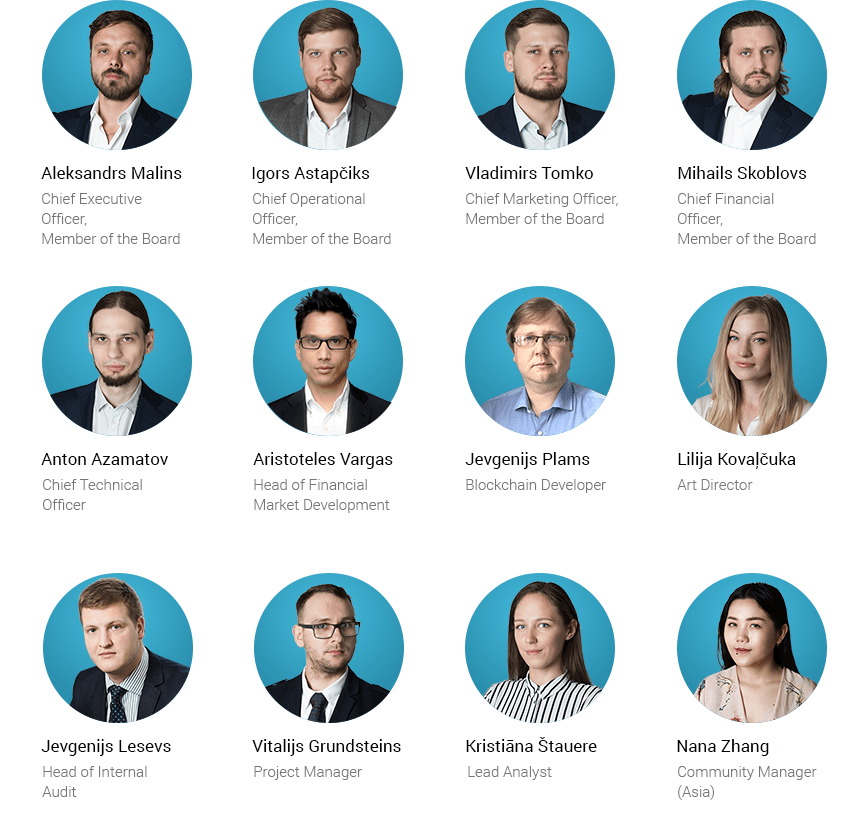

TEAM

For more information about Forty seven Bank, please visit the website below:

Medium || Bitcointalk || Whitepaper

Tehpucuk

https://bitcointalk.org/index.php?action=profile;u=1028340

Tidak ada komentar:

Posting Komentar